Customer Acquisition Strategies

Here's a great list of resources to help you develop a successful customer acquisition strategy.

CONTENT MARKETING INFORMATION & INSIGHT

CONTENT MARKETING INFORMATION & INSIGHTS

- 21 Tried & True Methods for Increasing Blog Traffic

- Content Strategy 101 (The Ultimate Beginner’s Guide)

- 5 Content Marketing Mistakes that Even the Pros Make

- Why Startups Need to Rise Above the Deluge of Crappy Content

- How to Create Viral Content (12 Proven Ways to Get People Talking)

- The 10-Step Content Marketing Checklist

- How 4 Top Startups Do Content Marketing

- 17 Blog Post Templates You Can Steal

CONTENT MARKETING BLOGS

CONTENT MARKETING TOOLS

SEARCH ENGINE OPTIMIZATION

SEO INFORMATION & INSIGHT

- Google’s SEO Start Guide

- Beginner’s Guide to SEO

- The Advanced Guide to SEO

- The Periodic Table Of SEO Ranking Factors

- SEO Copywriting Guide

- Perfecting On-Page Optimization

- Search Engine Ranking Factors Guide

- Simplifying SEO Guide

SEO BLOGS

SEO TOOLS

- Google Keyword Tool

- SEOmoz’s Tools

- SEOBook’s Tools

- Google Webmaster Tools

- Open Site Explorer

- Serp IQ

- Wordtracker Keyword Tool

EMAIL MARKETING

EMAIL MARKETING INFORMATION & INSIGHT

- The Email Marketing Essentials

- List Building for Blogs: The Only Guide You’ll Ever Need

- 50 Awesome Posts on Email Marketing

- The Ultimate List of Email Marketing Statistics

- Using Your Email List to Figure Out What People Want to Buy

EMAIL MARKETING BLOGS

EMAIL MARKETING TOOLS

COPYWRITING

COPYWRITING INFORMATION & INSIGHT

- How to Write Magnetic Headlines

- 85+ Copywriting Resources

- Headline Hacks

- How Content Length Affects Conversions & Ranking

- 7 Scientifically-Backed Copywriting Tips

- 10 Super Smart People Talk Copywriting for Conversions

- 10 Ways to Write DAMN Good Copy

COPYWRITING BLOGS

COPYWRITING TOOLS

CRO INFORMATION & INSIGHT

- The Conversion Rate Optimization Rulebook

- 50+ Awesome Posts on Conversion Rate Optimization

- 29 Case Studies on CRO

- 7 Usability Mistakes that Will Kill Your Sales

- Which Color is Best for Conversions?

- 7 Pricing Mistakes that Can Seriously Stifle Sales

- 16 Fresh Pieces of Conversion Advice

CRO BLOGS

- Unbounce blog

- Conversion Rate Experts

- ConversionXL

- Which Test Won?

- Visual Website Optimizer blog

- KISSmetrics Blog

CRO TOOLS

SOCIAL MEDIA MARKETING

SOCIAL MEDIA MARKETING INFORMATION & INSIGHT

- A Comprehensive List of Social Media Demographics

- Don’t Be a Social Media Cheater

- 40 Tips on Being a Genuine Social Media Rockstar

- The Marketer’s Guide to LinkedIn

- The Marketer’s Guide to Facebook

- The Marketer’s Guide to Twitter

SOCIAL MEDIA MARKETING BLOGS

SOCIAL MEDIA MARKETING TOOLS

ANALYTICS

ANALYTICS INFORMATION & INSIGHT

- 50 Resources for Making the Most of Google Analytics

- Why You Should Throw Away These Vanity Metrics

- The Ultimate Guide to Google Webmaster Tools

- Advanced Google Analytics Tips & Tricks

- How to Find Your Most Valuable Pages (and What to Do With Them)

- 9 Metrics & Analytics Info Your Startup Should Be Tracking

ANALYTICS BLOGS

ANALYTICS TOOLS

A Customer Experience Framework

A Customer Experience is an interaction between an organization and a customer. It is a blend of an organization’s physical performance, the senses stimulated, and emotions evoked, each intuitively measured against Customer Experiences across all moments of contact.

Great customer experiences are:

- A source of long-term competitive advantage

- Created by consistently exceeding customers’ physical and emotional expectations

- Differentiated by focusing on stimulating planned emotions

- Enabled through inspirational leadership, an empowering culture and empathetic people who are happy and fulfilled

- Designed “outside in” rather than “inside out”

- Revenue generating and can significantly reduce costs

- An embodiment of the brand

I recommend the following Customer Experience framework which focuses on 9 orientation areas of the business:

- People

- Culture and leadership

- Strategy

- Systems

- Measurement

- Channel approach

- Customer expectations

- Marketing and brand

- Processes

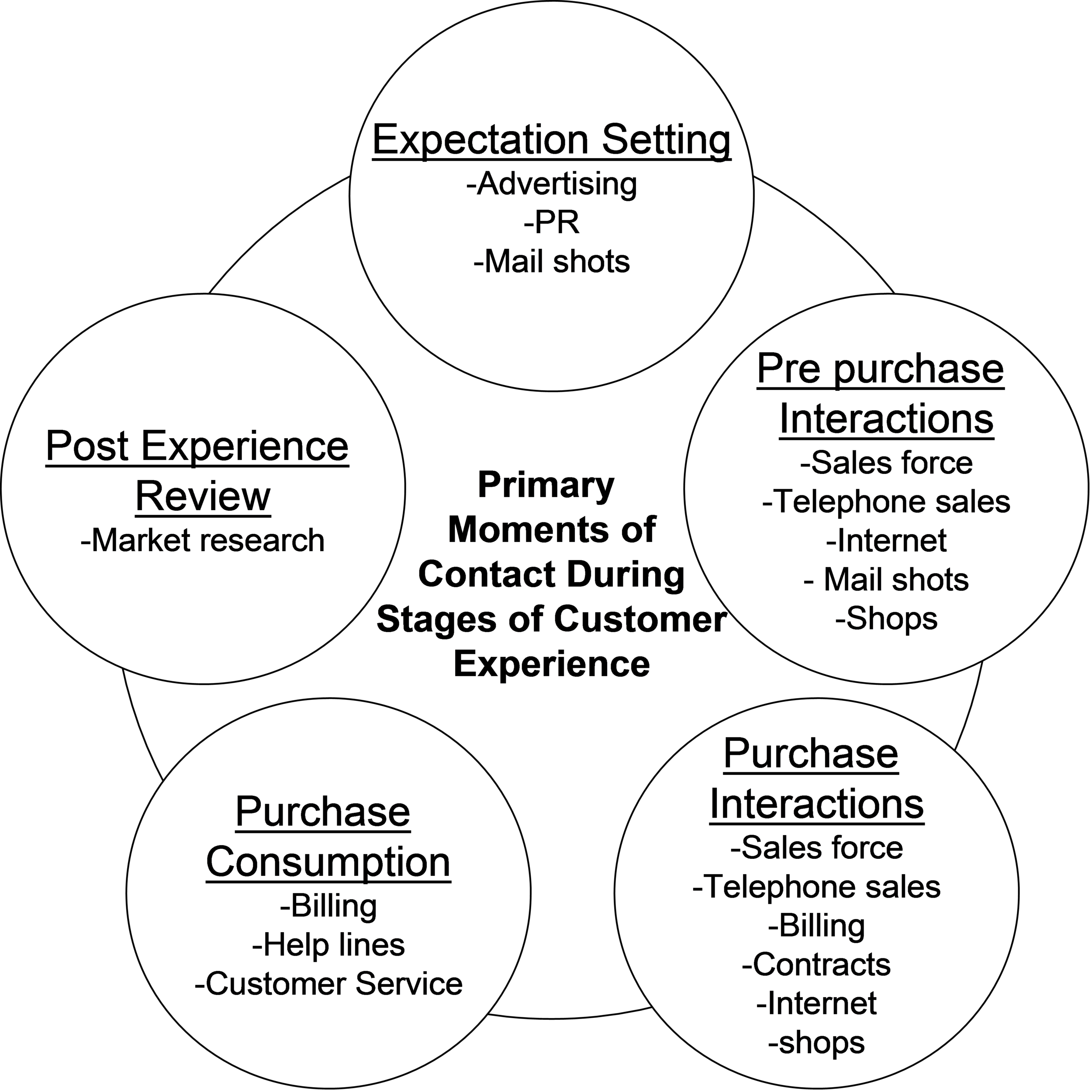

Let's look at the Customer Experience considerations for ‘channel approach’ and ‘physical’.

Channel approach – Consider the primary moments of contact during stages of the customer experience, the appropriate functional structure required to manage the customer experience, and the customer’s moments of contact.

It’s increasingly difficult to manage the Customer Experience as the distance between the brand and the customer increases.

It is also important to understand the customer’s emotional readiness and confidence levels in order to move them to less expensive moments of contact.

Physical – When considering the physical customer experience, there are 11 categories:

Each of the above orientation areas has indicators that ultimately makeup the company’s orientation. There are four orientations:

Naïve – an organization that focuses on itself to the detriment of the customer. It is “inside out” either through choice or because it doesn’t know what is should be doing.

They tend to focus on themselves rather than the Customer Experience. They are reactive top customer demands. They believe the product, processes, or their services are more important than the customer. Their attitude with the customer is one of “take it or leave it” or “what do you expect from a product at this price?” Their processes are totally focused “inside out”, doing things for their benefit, rather than “outside in,” which is changing the organization to meet customer requirements.

The naïve oriented organization is organized around its products. These products overlap and are uncoordinated. It is typically a siloed organization and infighting between the silos is rife.

The organization is either in this orientation because they are:

- Unaware what they should be doing to build a great Customer Experience. They are not deliberately trying to cause a poor Customer Experience; it is simply that they do not know what they do not know. They are unaware of the impact on their Customer Experience. By definition they have not spent time thinking through the implications of what they are dong. This typically indicated they believe something else is more important than the Customer Experience.

- Aware of their orientation but simply don’t care as customers are a nuisance, and seen as a means to an end.

Naïve organizations typically target their people on sales or productivity, use internal measures, and either do not understand customer satisfaction surveys or take little notice of the results if they do.

Transactional – an organization that focuses primarily on the physical aspects of the Customer Experience; It has recognized the importance of the customers. However, it focus is rudimentary, as many aspects of the Customer Experience remain left to chance and are uncoordinated and “inside out.” The organization is typically reactive to customer demands.

They understand some of the basics of the Customer Experience but still remains reactive to customer demands. It has recognized that the customer is “quite” important and it has made some changes to reflect this. The core of its operation is primarily around the physical aspects of the Customer Experience, for example, opening times, answering calls in four rings, accessibility through the call centers, delivery times. It is, in reality, still “inside out” and its Customer Experience is not deliberate, but just happens. IT does not measure customer satisfaction but it is fundamentally focused on physical elements of the Customer Experience. Some employees are targeted on general customer satisfaction but this is, at best, an afterthought, compared to the important measures of sales and productivity. It has established a customer service organization but typically these employees are treated like second-class citizens.

Organizationally is often functionally siloed, with each silo treating the customer in a different manner. Little information is shared across the functions and customers are forced into dealing with many parts of the Transactional organization to get problems resolved. “Solutions” are billed separately, showing the lack of true coordination with the organization.

Enlightened – An organization that has recognized the need for a holistic, coordinated, and deliberate approach to the Customer Experience. It is proactive in nature towards the customer and orchestrates emotionally engaging Customer Experiences. It stimulates planned emotions.

The Enlightened oriented organization understands the importance of the Customer Experience and has thus achieved enlightenment. It has converted from being reactive to proactive to customer demands. It has understood the critical nature of defining the Customer Experience it is trying to deliver. It has spent time discussing this at a board level and agreed a Customer Experience statement, which has been communicated to all employees. It realizes that over 50% of every Customer Experience is about emotions and therefore it has embedded new processes into its Customer Experience, which are planned to to deliberately evoke emotions. Enlightened organizations recognize that customers have emotional expectations, as well as physical expectations, and plan to exceed both.

The Enlightened organization has formal methods to ensure that people spend time with the customer. This applies from the most senior members of the board to the intern. The leadership walks the talk regarding the Customer Experience.

Natural – an organization where focus on the customer is total. It is very proactive and is naturally focused on the complete Customer Experience. In order to produce memorable and captivating Customer Experiences it uses specific senses to evoke planned emotions.

In this orientation, the Customer Experience is in the organizations’ DNA. It does not have to consider what to do as it does it naturally. It understands the critical role that senses plan and has deliberately builds these into the Customer Experience. It understands that customers have sensory expectations and then use the senses to create captivating and memorable experiences. It involves the customer in the design of the Customer Experience and has defined its own Customer Experience Recipe. It is totally proactive to customer demands and undertakes many activities, which even the customer does not see, to build a great Customer Experience.

It recognizes the amazing power of “stories” and “storytelling,” both inside and outside the organization, and it uses these to great effect to build its unique Customer Experience. Its leadership, and everyone in the organization, has been selected to meet its deliberate Customer Experience. Its culture is aligned to the Customer Experience and is seen as an enabling tool. It uses theatre as a method of producing consistency of its Customer Experience. It considers the product or service it sells of secondary importance, as it knows if it gets the Customer Experience correct then the rest will follow. It has aligned the brand and its Customer Experience and one supports the other. It has very sophisticated methods of collecting customer data, which it constantly uses to improve its Customer Experience. Its systems look at the holistic Customer Experience and provide relevant data at points of contact with the customer.

The below chart indicates an organization’s orientation across three axes:

- X axis = the progression of an organization’s strategy on differentiation – from traditional product features, to service, then through to Customer Relations (ie: personalization and customization supporting relationship marketing) and finally then using Customer Experience as the primary source of differentiation.

- Y axis = the organization’s deliberate use of different facets of the Customer Experience, moving from product, through physical, to emotional and finally sensory.

- Z axis = denotes how customer focused the organization is.

The Customer Experience Hierarchy of Needs highlights the basic elements of the Customer Experience people wish to have in place before they can move up the hierarchy. It is at the top two levels that companies are able to differentiate themselves and provide deliberate Customer Experience. In most cases the top two levels are emotional elements and it is the customer who should determine what these elements are and if they are important.

Key Account Manager Basics

A Key Account Manager is an interesting role as you get the opportunity to wear many hats including consultant, adviser, project manager, sales executive, colleague, team member, and friend. Many companies split account management responsibilities into different specialty roles such as Account Director, Account Manager, Solutions Architect, and Inside Sales Executive. However, based on my experience, a GOOD account manager is a special type of person with a varied skill set; they need to be excellent at building relationships, communicating, problem solving and personal selling.

To be a successful Key Account Manager, I recommend the following:

Be Customer Oriented: It’s all about the customer’s business and industry. Understand your customer’s business drivers, structure, and strategies to ensure your propose the appropriate solutions with the maximum business impact. You need to establish trust and create meaningful value for your client.

Be Knowledgeable: You need to be knowledgeable and understand the goals and priorities of your client. Know the industry and the company’s products or services. Understand the competition, as well as their strengths, weakness, and vulnerabilities. Be a subject matter expert and provide advise and insight to help your client differentiate its products / services, increase revenue, and improve their overall customer experience.

Be a Strong Communicator: Effective communication is crucial for making professional presentations to a group, establishing one-on-one rapport, writing detailed reports, and communicating via email and phone conversations. A good account manager clearly articulates the company’s products or services and explains the advantages to clients in a way that is persuasive without being pushy.

Be Results Oriented: A good account manager that understands their client's needs, builds trust, and establishes a rapport and build loyalty and maintain a profitable account. You should always look for opportunities to add value; monitor sales activity and actively seek ways to upsell products and services. If you're honest, trustworthy, and perceived as adding "value", you can foster a successful client retention strategy and generate referrals from existing clients.

Have Good Business Judgment: Account growth comes from business growth and helping your client win. Provide meaningful business insight, leadership, and solutions from the client's perspective.

Build Relationships: Continuously build and foster relationships with key stakeholders. Know your client's as a person - not just a work colleague. By understanding the individual you're better able to understand their thought process, motivators, concerns, ambitions, etc. Try and have a monthly "informal" meeting out of the office in a more relaxed setting. I suggest you not only build rapport with your project counterpart but as many of the project team members as possible Your objective is to be viewed as a "colleague" - not an external consultant.

Build Collaboration: A successful Key Account Manager creates a relationship that moves up the value chain away from a basic transactional relationship to an interdependent relationship. You want to build the relationship to the point where it's difficult for the client to switch suppliers because you have a strategic, high-value relationship. Your objective should be to build a partnership relationship.

To be an effective Key Account Manager, you need to have the following:

Personal Traits

- Trustworthy

- Tact

- Integrity

- Responsibility

- Creativity

- Self-Motivation

Skills

- Relationship Building

- Negotiation

- Communication

- Leadership

- Coordination

- Presentation Skills

- Conflict Resolution

An Outsourcing Toolkit

If you're considering outsourcing your front/back office operations, then you need a well-defined process and methodology to help you in your decision. I’d like to share with you my approach based on my experience as both a provider and client. There are three key focus areas:

- Providing support for the sourcing decision.

- Providing support with client implementation and capability transfer.

- Ongoing management.

FOCUS AREA 1: Provide support for sourcing decision

A client’s decision to “outsource” is driven by a number of key imperatives such as costs, business maturity, infrastructure needs, etc. Contact center activities, both front and back office, can be sourced in four ways:

- Outsource the activity to an offshore location.

- Outsource the activity to an onshore location.

- Retain the activity in house, but move it to an offshore location.

- Keep the activity in house.

Companies should assess each option using a decision tree across four components:

(1) Competency assessment: This is typically performed by the company with very little external involvement. Companies must decide identify which of their contact center activities provide a level of competitive advantage. Each activity should be assessed against its exportability to a vendor and value to the company. For example:

- Basic services offer a low competitive advantage and are typically routine, easy to teach, process-driven, and objective. For example, billing, collections, order change, order inquiry, and service requests.

- Supportive services are important to the company’s value proposition and tend to lean either towards basic or differentiating. For example, website support and order taking are more basic verses complaint resolution, fraud detection, customer feedback, and up-sell/cross-sell.

Differentiating services significantly contribute to a company’s competitive advantage. For example, customer retention, concierge services, or sales configuration.

This is a critical step in the decision making process. It forces companies to identify their core business processes / activities and identify their “competitive advantages” that must remain in-house. This step is different for new startups verses more mature, companies with established processes, procedures, and systems.

(2) External complexity: Companies need to identify legal considerations such as data transfer, data security, customer data, activity related soft skills, company reputation, and language nuances.

(3) Internal complexity: Companies must assess the feasibility of moving or integrating customer, process, and product knowledge; interactions with other parts of the firm; and information and security systems. For example: the level of required system integration, geographical distance impact on process integration, product and process knowledge exportability, and security concerns and safeguards. Typically home-built systems that integrated with many processes are difficult to outsource.

It’s in the best interest of the outsource provider as this stage to work together with prospective clients and identify problematic complex processes - companies cannot outsource problems. Any potential cost savings will be offset due to increased integration, knowledge transfer, or additional oversight requirements.

(4) Country / vendor: Country’s typically fall into tier 1, 2, or 3 based on costs, business conditions, and people skills and availability. The level of importance of each category will vary company to company but I see a key part of this role as “selling” a particular location. For example, educating the client about average wages, corruption, fluctuating exchange rates, contact center market size, total workforce availability, university-educated, attrition rates, unemployment rates, work ethic, maturity of legal structure, infrastructure quality, and time zone.

A main issue faced in the vendor selection process is the seemingly endless differences between vendors. I typically use a structured selection approach with nine attributes as this stage assigning a 1-5 score and associated weight. Attributes include strategic fit and corporate capability, engagement governance model, cost benefits, technology, infrastructure, process maturity, people development, culture, and customer satisfaction.

FOCUS AREA 2: Providing Support with Client Implementation and Capability Transfer

Post vendor selection involves a number of tasks necessary prior, during, and after activities have been transferred. There are three key areas:

(1) Life-cycle based vendor relationship management: I’ve previously utilized a five-stage life-cycle model to understand and sequence the activities necessary to meet outsourcing goals. The model provides a “framework” for analyzing risks across service delivery, technology, and financial risks. The objective is to define the vendor-client relationship and how the relationship should evolve over time.

- Transition processes to vendor

- Implement system and process upgrades

- Extend functionality of systems and processes

- Link outsourced systems to processes

- Evaluate sustainability of relationship

At each stage of the model, I apply five different steps to ensure risk mitigation and governance objectives:

Step 1: Apply life-cycle model: For example, after the deal is signed the client begins the process of transferring systems and or processes to the vendor. To mitigate the potential risk of a suboptimal transfer, the project assigns multiple project managers and change management and system experts. Another example is the potential of misaligned outsourcing and service needs after completed the transfer from client to vendor. In this case, the project team may need additional relationship managers to resolve any potential alignment issues.

Step 2: Identify outsourcing risks: The project team should conduct an internal risk assessment across the organization (ie: Corporate Executives, Business Unit Executives, Functional Heads, and HR) to identify risks across three categories: (1) Service Quality, (2) Technology, and (3) Financial.

Step 3: Set governance objectives: After defining the outsourcing goals and risks, the core project team formulates objectives for each phase. For example, Transition Phase > Service Quality > [1] Coordinate and develop an employee communication strategy [2] Vendor input on early “trouble spots” to prevent widespread issue occurrence.

Step 4: Configure core governance team: The team composition is tailored directly to the key objectives and risks: Services, Technology, and Finance. Core team member roles would include for example, Vendor QoS Manager, Internal Communications Manager, Process Manager, and Finance Manager.

Step 5: Adjust vendor management team: As the project life-cycle needs change, additional project team members may be required. For example, during the high-risk implementation stage, additional staff will be required.

A life-cycle based management project approach allows companies to mitigate risks, meet stage specific project team staffing needs, and achieve key objectives and economic benefits such as capital cost avoidance, operational risk mitigation, service level agreement productivity, and cost predictability. Utilizing such a model generally leads to a successful project and contract renewal.

(2) Agent recruitment and selection: Recruiting and selecting the initial team is comprised of two components: (1) Setting expectations for the agent and manager positions and (2) Ensuring a proper fit.

You should work closely with the project team to define the initial set of desired competencies including both hard and soft skills. For example, writing skills, analytic abilities, previous experience, team fit, cultural fit, enthusiasm, active listening skills, etc. Applicants are pre-screened based on job skills required for current agent positions and aptitude for future, higher-value work.

By thoroughly explaining expectations, job responsibilities, and the direction of the center, the client should benefit from a higher acceptance and retention rate, ensure productivity goals are achieved, and client expectations are met.

Staffing the new team is always a critical project phase as it requires a balanced mix between experienced and newly hired agents.

(3) Accelerating agent experience: To ensure the long-term success of the project, it’s critical to develop the desired and sustainable capabilities within the agent pool. After establishing a base-line metrics (both objective/subjective measures) such as customer satisfaction rates, average response rate, average processing time, etc., specific problem areas can be identified. For example, agents may understand call procedures, but lack initial experienced based training. As a result, agents are able to handle a call, but do not necessarily meet customers’ expectations.

Ensure a management-led, experience-based training program is in place to ensure a successful transition across three areas:

- Hands-on senior-to-senior management training (ie: jointly listening to real calls) to highlight improvement areas and to explain goals and expectations via real examples.

- An immediate agent feedback process and coaching when necessary.

- Continuous ranking between centers/teams handling distributed calls/activities.

FOCUS AREA 3: Ongoing Management

A successful client/vendor relationship distinguishes itself through a deep understanding and ownership of communications across a continuum in addition to an appropriately structured service level agreement, incentives, and penalties.

- Instilling company vision: ensure the outsource partner’s management and front line staff not only understand the product/service and customers, but also the firm’s vision and culture as it relates to the contact center. The company vision must be reflected in all customer interactions! Some tactics to ensure agents working for the client are treated and perceived as their own include: client participation in hiring/training and product/service discounts.

- Formalizing vendor communications: regularly scheduled meetings to discuss key metrics and performance requirements. For example, meeting with the client on a weekly basis for joint “calibration” session to review metrics and performance requirements thus ensuring both parties rate customer interactions similarly. Joint long-term strategic planning will help drive efficiency, ensure productivity, assess quality scores, address staffing needs, forecast call volumes, and strengthen the vendor relationship.

- Reacting to metrics: jointly assess drivers of efficiency disruptions and work together to address these issues. This ensures meaningful dialogue to identify “root-cause” analysis and respond accordingly. For example, reviewing daily metrics to isolate key business drivers leading to productivity issues.

Capturing and relaying customer insight: collaboratively identify the drivers of customer behavior and use the information to improve service. For example, jointly develop a dispositions tool to assess the reason behind each customer contact and to understand how to improve overall service.